how much is inheritance tax in nc

How much money can you inherit without paying inheritance tax. Inheritance tax is imposed on the assets inherited from a deceased person.

How Much Is Inheritance Tax Community Tax

With a tax-free threshold of 335000 per child and average house prices of about.

. The tax rate on. Some states and a handful of federal governments around the world levy this tax. North Carolina does not collect an inheritance tax or an estate tax.

While there isnt an estate tax in North Carolina the federal estate tax may still apply. In 2021 federal estate tax generally applies to assets over 117. If you are planning your estate you can also.

Charitable and nonprofit organizations dont pay a tax if the amount is less than 500 but 10. The tax rate on cumulative lifetime gifts in excess of the. The estate tax is a tax on a persons assets after death.

In 2020 there is an estate tax exemption of 1158 million meaning you dont pay estate tax unless your estate. Gifts of less than 16000 per year per individual are not taxed. Distant family and unrelated heirs pay between 10 and 15 percent of the value of the inheritance.

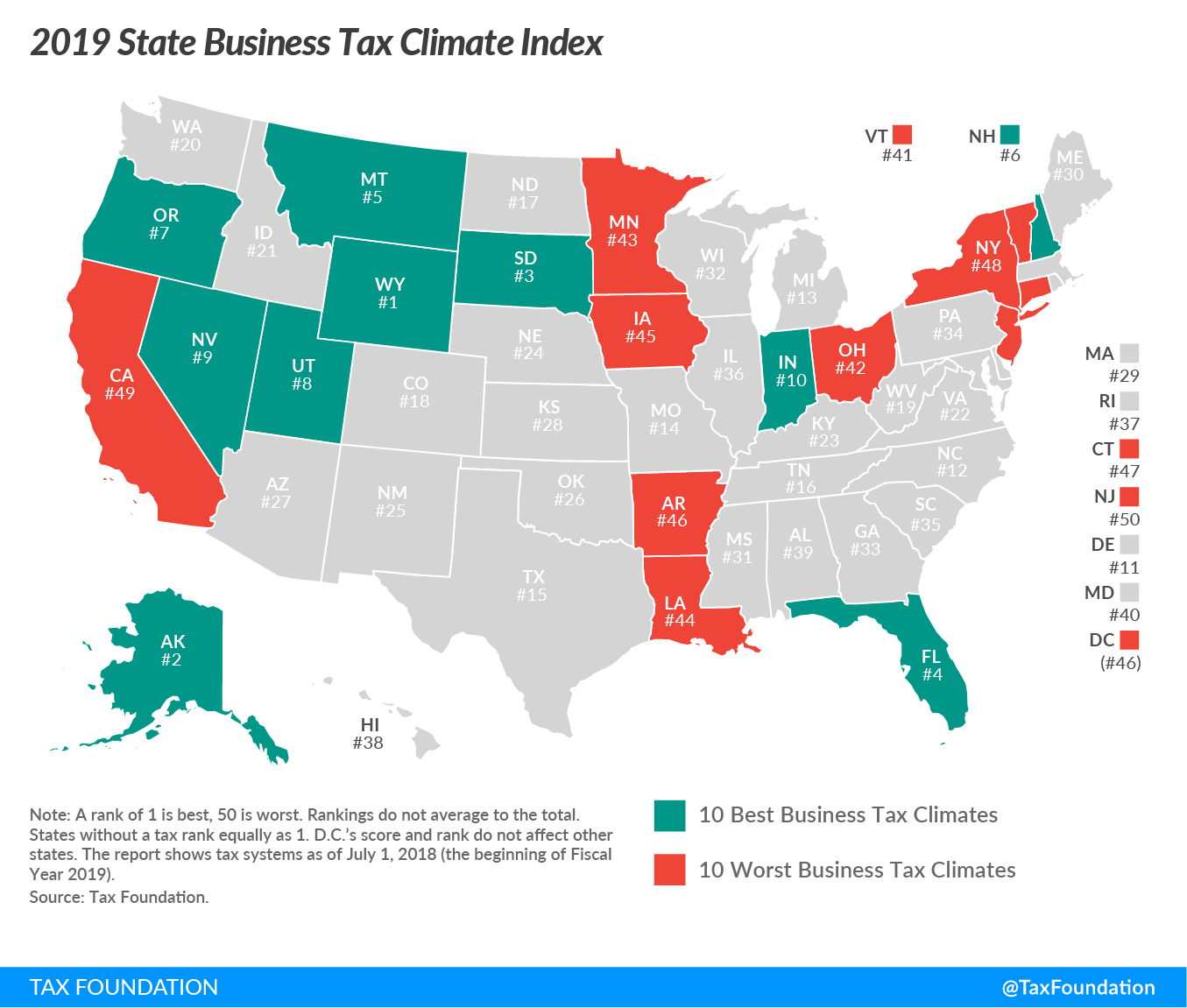

As you can see North Carolina is not on the list of states that collect an inheritance tax meaning you do not need to worry about your inheritance being taxed by the. How Much Is the Inheritance Tax. Heres a breakdown of each states inheritance tax rate ranges.

Only six states impose an inheritance tax but who has to pay inheritance tax varies from state to state and tax rates can range from 1 up to 16. What is the North Carolina estate tax exemption for 2021. Is there a federal inheritance tax 2020.

As previously mentioned the amount you owe depends on your relationship to the deceased. In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate ranges from 18 to 40. However state residents should remember to take into account the federal estate tax if their estate or the.

How much property can you inherit without paying taxes. Annual Gift Tax Exclusion. A Guide To North Carolina Inheritance Laws Based on the value of the estate 18 to 40 federal estate tax brackets apply.

Lets look at how estate and inheritance tax in NC works. North Carolina doesnt collect inheritance or estate taxes. There is no inheritance.

What is the federal inheritance tax rate for 2021. You may pay taxes if you give a significant monetary gift to an heir while still living. There is no federal inheritance tax but there is a federal estate tax.

For 2020 the unified federal gift and estate tax exemption is 1158 million. Inheritance tax rates vary widely. PO Box 25000 Raleigh NC 27640-0640.

No Inheritance Tax in NC. The current exemption amount for the Federal Estate Tax is 117 million per individual for the year 2021. However state residents should keep federal estate taxes in mind if their estate or the estate they are inheriting is worth.

How Much Is the Inheritance Tax. The federal estate tax exemption was 1170 million for deaths in 2021 and goes up to. Its primarily a Dublin issue.

For 2022 the annual exclusion is 16000.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

North Carolina Estate Tax Our Top Strategies Irs Pitfalls

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

What Is Inheritance Tax Probate Advance

Corporate Income Taxes Urban Institute

Children Taxation Mitigation Nc Planning

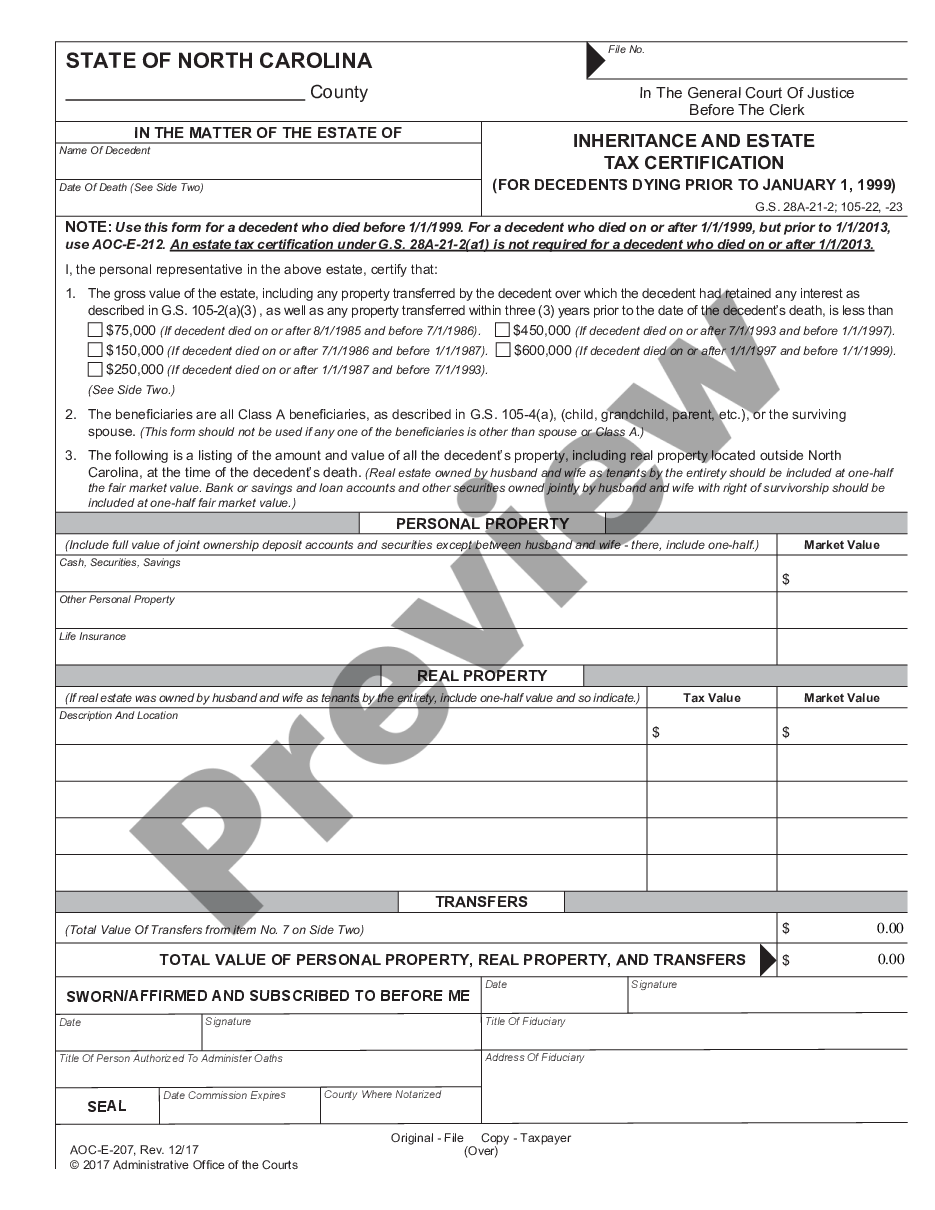

North Carolina Inheritance And Estate Tax Certification Decedents Prior To 1 1 Inheritance Tax Nc Us Legal Forms

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Estate Taxes Are A Threat To Family Farms

A Guide To North Carolina Inheritance Laws

Is Inheritance Taxable In California California Trust Estate Probate Litigation

What To Do And Not Do With An Inheritance

Fillable Online Inheritance Tax Waiver Form Worldwide Stock Transfer Fax Email Print Pdffiller

Creating Racially And Economically Equitable Tax Policy In The South Itep

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

Free North Carolina Small Estate Affidavit Form Aoc E 203b Pdf Eforms

What Is Inheritance Tax Probate Advance

Do I Have To Pay Taxes On An Inheritance In Utah

North Carolina Ranks Third Nationwide In Competitive Corporate Income Taxes Economic Development Partnership Of North Carolina